The unprecedented scale of Woking Borough Council’s financial meltdown has left many shocked and fearful over the fate of valued services, writes Chris Caulfield of the Local Democracy Reporting Service.

However, the council has said no decision will be taken locally until an emergency meeting of its full council sits next Tuesday (June 20) – and even then it won’t be until July when new budget plans are signed off, at the earliest.

The void has left residents in limbo while the council tries to get itself out of its own mess – a £2.6billion debt and a deficit of more than £1bn that it has admitted it cannot pay back on its own and will seek government help.

We discussed what has happened before when other local authorities issued Section 114 notices, whether these are open to Woking’s council, what a government bailout could mean and how hard will residents be impacted.

A Section 114 notice is when a council declares itself unable to maintain a balanced budget and can no longer afford its day-to-day costs. All new spending is immediately halted and it will fund only services it is obligated to by law.

The borough council went bust after borrowing hundreds of millions of pounds to invest in massive town centre regeneration projects, including Victoria Square.

‘Raising council tax in Woking would be difficult’

Mr Pike, a leading academic at Newcastle University’s Centre for Urban and Regional Development Studies, said: “In Croydon tax went up by 15 per cent this year but in Woking it’s going to be difficult because of the scale of it.

“The council would raise only a few million more and that wouldn’t get close to servicing the debt. Yes, even council tax increases, if allowed by national government, would make only a contribution to the situation.

“The treasury and the Department of Levelling up, Housing and Communities will be extremely cautious and nervous about picking up the tab.

“They don’t want to create a moral hazard – in other words, an incentive – for financial recklessness at other local councils; that 'if you get in a pickle we will always get you out of it. If you get into problems the national state will step in'.

“The UK government guarantee is implicit rather than explicit in the eyes of international investors.”

The council has given some hints about what may be down the road in papers published ahead of its extraordinary full council next week.

The report says plans to bring its “budgets back into balance will have a significant impact on the communities of Woking” adding the council will begin divesting its “assets and investments in order to contribute to the funding of recovery and sustainability of the council’s finances and reduction of its debt”.

The council has also conducted what it describes as as a “searching and continuing review” of its financial affairs and found 11 main issues.

These included that it advanced £160million borrowed from the Public Loan Works Board to its own companies for capital and revenue purposes – which is “outside” regulations.

Sell off trophy assets?

The danger of selling its trophy assets, Mr Pike said, would mean the council took “a big financial hit” selling property and land for significantly less than they paid for it – and would lose control of those sites’ futures.

The nearest example to Woking is perhaps found in Slough which went under last year after borrowing £760m to invest in major capital projects.

Slough, like Woking, uncovered historic accounting errors and financial mistakes.

Residents there were hit with a 9.9 per cent rise in council tax this year but even that has managed to bring in only an additional £3.2m in income, amid a backdrop of £22.4 million in cuts.

As for how the council gets out of its debt, Mr Pike said: “That’s a really difficult question.

“Looking back at history, you’ve had this happen in Northamptonshire, Croydon and Slough.

“Northamptonshire was split into two new local authorities while in other councils they brought commissioners in who recommended wholesale organisational change.”

But Woking has already replaced the senior leadership at the council.

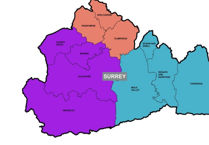

Mr Pike added: “A local government reorganisation fix is unavailable especially given the county and other districts in Surrey won’t want to get embroiled.

“Making Surrey a unitary authority wouldn’t work. It would just spread the debt and when you chuck in Spelthorne and Runnymede – there’s a lot of nervousness – so there isn’t a local government restructure fix.”

According to UK parliament’s commons library, If every single council in the UK raised its council tax by the maximum allowed, an additional £1.6bn would be raised – £1bn less that Woking’s debt.

‘The UK treasury needs to worry about Woking’s £1.6bn borrowing’

Mr Pike said local authorities could be broken into three groups, based on how much risk they were willing to take on.

Leading the way are councils he describes as “vanguards exploring the boundaries of what’s allowable under the Localism Act 2011” having been “compelled into risk taking by austerity from 2010”.

Woking Borough Council, he said, “seems a clear example of one of the vanguard councils”.

“My view of these councils is they are led by councillors who rely on senior officers’ legal and commercial experience and are open to greater risk taking and new ideas.”

“The risk,” however, “needs to be mitigated and managed properly” and in Woking “the huge scale makes it stand out even among the vanguard”.

He said: “It’s the sheer scale of it, with borrowing in excess of £1.6bn, that the UK treasury needs to worry about.”

The borough council’s government-funded spending power has fallen since 2010 by 69.2 per cent, in real terms, according to the National Audit Office.

Post-2010 and the introduction of the Localism Act, local authorities were compelled to cut costs and generate income to balance the books. Buoyant markets proved enticing to many councils which then borrowed heavily to invest in town centre shopping centres. It led to a surge in over risky and over ambitious schemes being taken on.

What Woking Borough Council says

A spokesperson for Woking Borough Council has said that as part of the formal Section 114 Notice process, an extraordinary meeting of the full council would be held on Tuesday, June 20 where councillors will discuss the notice and our proposals to meet the financial challenges ahead.

They added that it would “not be appropriate” to comment before any decisions are made.

.jpeg?width=209&height=140&crop=209:145,smart&quality=75)

.jpeg?width=209&height=140&crop=209:145,smart&quality=75)

Comments

This article has no comments yet. Be the first to leave a comment.